Free payroll tax calculator 2023

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Use this simplified payroll deductions calculator to help you determine your net paycheck.

Payroll Template Free Employee Payroll Template For Excel

How to calculate annual income.

. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. And is based on the tax brackets of 2021 and. For example if an employee earns 1500.

Free 2022 Employee Payroll Deductions Calculator. See your tax refund estimate. If payroll is too time consuming for you to handle were here to help you out.

What is your total. Sage Income Tax Calculator. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Which tax year would you like to calculate. Paycheck to get a bigger refund Get started. Multiply taxable gross wages by the number of pay periods per.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

See where that hard-earned money goes - with UK income tax National Insurance student. Estimate your tax refund uncover deductions and credits. Well calculate the difference on what you owe and what youve paid.

If youve already paid more than what you will owe in taxes youll likely receive a refund. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay. It is mainly intended for residents of the US.

We hope these calculators are useful to you. Calculate how tax changes will affect your pocket Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Free tax calculators and tools.

Subtract 12900 for Married otherwise. Some states follow the federal tax. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

Its so easy to. 2022 Federal income tax withholding calculation. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms 401k savings and retirement calculator and. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

When you choose SurePayroll to handle your small business payroll. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. The maximum an employee will pay in 2022 is 911400.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Computes federal and state tax withholding for. Start the TAXstimator Then select your IRS Tax Return Filing Status.

The state tax year is also 12 months but it differs from state to state. Withholding schedules rules and rates are. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

Tax Calculator India 2022 2023 Apps On Google Play

Employee Retention Credit Erc Tax Refunds Sbam Small Business Association Of Michigan

Uk Salary Calculator 2022 2023 By James Still

Tax Refund Estimator Calculator For 2021 Return In 2022

2022 Capital Gains Tax Rates By State Smartasset

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Free Excel Download Commerceangadi Com

How To Fill Out And Submit A W 4 Form To Your Employer

Update 1031 Exchange What 2023 Tax Reform Could Mean For Nnn Investing The 1031 Exchange Westwood Net Lease Advisors Llc

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

Tax Year 2023 January December 2023 Plan Your Taxes

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Uk Salary Calculator 2022 2023 By James Still

Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes

Estimated Income Tax Payments For 2023 And 2024 Pay Online

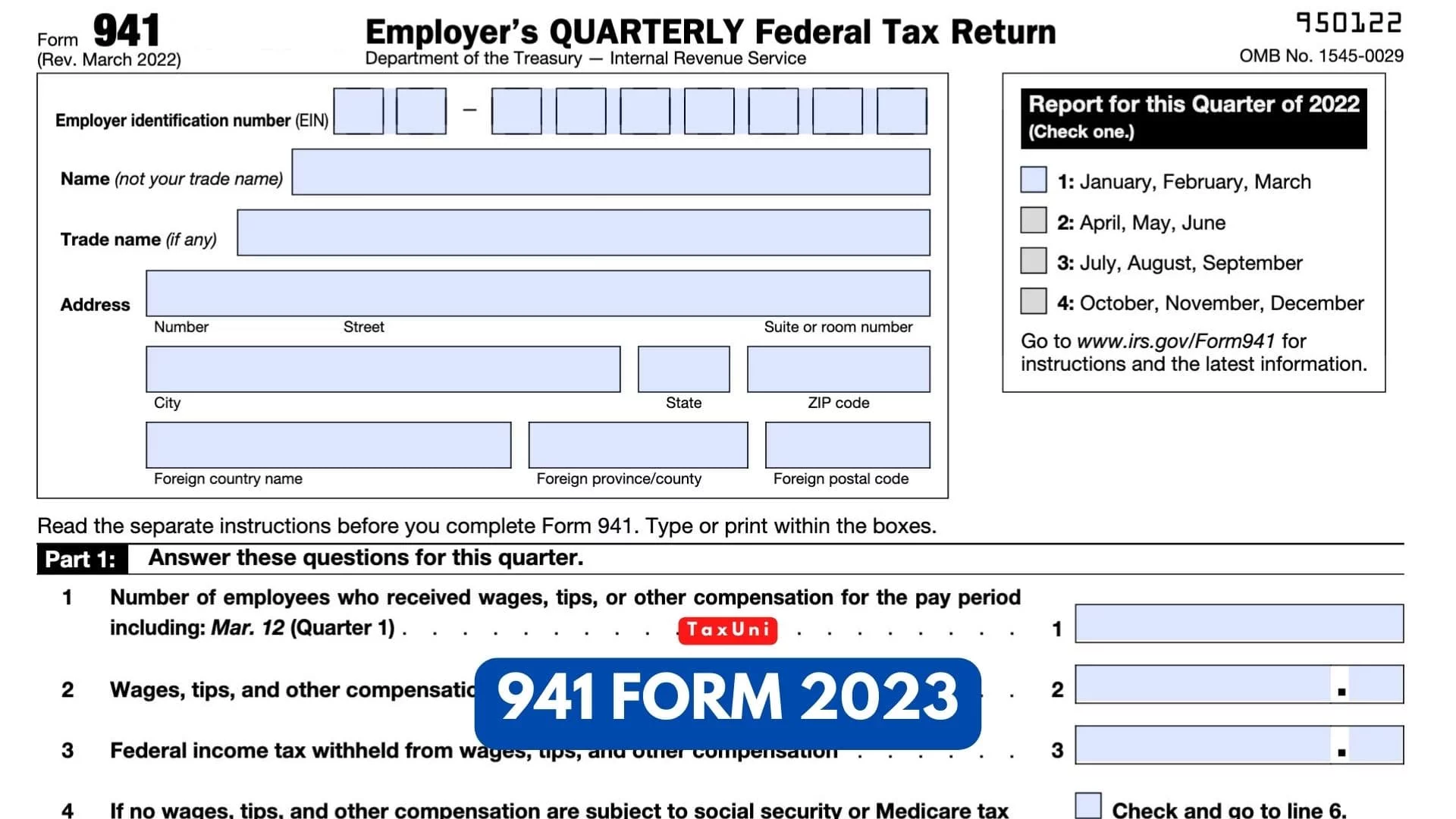

941 Form 2023

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia